For long time wine snobs considered Luding to be an importer and distributor of cheap supermarket plonk. Maybe the majority of Luding revenues is still coming from cheaper wines, the perception of the company has dramatically changed during the past several years thanks to the arrival of their fine wine project – “L-wine”.

The team behind the project is definitely passionate about fine wine education in Russia. “Le tour de vin” that took part at Ritz Carlton just in froте of Kremlin on the 12-13 of March is another good example of sharing fine wine knowledge with the right audience.

The team behind the project is definitely passionate about fine wine education in Russia. “Le tour de vin” that took part at Ritz Carlton just in froте of Kremlin on the 12-13 of March is another good example of sharing fine wine knowledge with the right audience.

Olivier Poussier – a world-famous sommelier working with L-wine wine portfolio – came to Moscow to present in person the wines of Château des Rontets, Domaine de Montille, Domaine Jean-Paul & Benoît Droin, Domaine Michel Bouzereau et Fils, Domaine Jean-Claude Bachelet et Fils and many more. He also held a tasting of Domaine Jean-Paul and Benoît Droin wines of Chablis. Michel Drappier was also here to talk ensure his Champagnes are not left alone. Chateaus Chasse-Spleen wines has also been tasting in a vertical flight.

Another impressive tasting included the Loire wines from L-wine and was conducted both by Poussier and Patrick Baudouin (Domaine Patrick Baudoin).

Mr. Poussier also commanded a dinner with a wine quiz and a raffle that offered a trip to L’Ecole des Vins de Bourgogne as a main prize.

]]>

Mikhalkov himself stated the total wine production would be around 250 000 bottles a year. The first Cabernet Sauvignon bottlings will appear in the wine lists of Moscow restaurants “very soon”. Together with his partner Konstantin Tuvykin he will also produce a white wine – still under consideration. The actor also mentioned that the staff working at the winery is fully Italian.

Mikhalkov himself stated the total wine production would be around 250 000 bottles a year. The first Cabernet Sauvignon bottlings will appear in the wine lists of Moscow restaurants “very soon”. Together with his partner Konstantin Tuvykin he will also produce a white wine – still under consideration. The actor also mentioned that the staff working at the winery is fully Italian.

Although Mikhalkov didn’t state the name of the property, we deduced it was Castello di Casole which is not simply a winery, but an established luxury boutique wine resort in the midst of the rolling hills of Tuscany.

Meanwhile, the estate web-site reads that the total area under vine is 100 acres which makes it about 40 hectares.

Mikhalkov moved fast – the first 16 000 bottles of 2009 vintage red wine have already passed customs control in the Russian capital and you bet they will sell out quickly. During his press-conference at RIA-Novosti news agency he demonstrated a Silvio Berlusconi photo with an inscription which read: “Thank you for the dialog and for the wine especially”. We also know that the wines had already been tasted by Vladimir Putin. We have no information whether Berlusconi or Putin praised the wines or flushed them quietly.

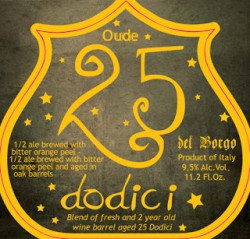

The filmmaker’s red wine will be called “12” engraved with gold-color letters on the black label, named after one of the recent movies with the same name “Twelve”. Mikhalkov also mentioned that he just liked how the number sounded in Italian — Dodici. Should we mention that the pronunciation of this word in Russian langauge refers us to «an idiot» or «a cretin».

Mikhalkov’s wines have all the chances to become a great success in Russia – just yesterday he was celebrating his farther’s Sergey Mikhalkov 100-th anniversary – together with the country ‘s Prime Minister Dmitry Medvedev.

Mikhalkov’s wines have all the chances to become a great success in Russia – just yesterday he was celebrating his farther’s Sergey Mikhalkov 100-th anniversary – together with the country ‘s Prime Minister Dmitry Medvedev.

Mikhalkov stated that his knowledge of fine wines was not sufficient to fully manage the winery. For example, he is unaware about the age of the vines he co-owns in Tuscany. According to Mikhalkov and his partner they are negotiating wine import exclusive rights with two big wine importers in Russia and are not planning to import the wines themselves. Some sources indicate that Maxim Kashirin’s Simple wine importer could be the chosen one to deal with the wines in Russia.

Nikita Mikhalkov is famous not only for his actor/director talents, although doubted by many, but also for being an active politician who had introduced many controversial and questionable practices (i.e. alloting public funds).

]]>This “kind” initiative from Gennady Onischenko – well known for his ridiculous control measures and derisive statements – has already provoked Georgia’s president Saakashvili anger. On the 26th of February the leader of Georgia criticized Georgian winemakers for playing ball and fawning upon the Russian officials and pouring their wines into the inspectors’ glasses “with trembling hands”. Saakashvili also proposed to “put something in their pockets for them to leave happily”.

Reacting to these statements Onishenko was even planning to cancel the inspection but didn’t implement his threats. Georgian emotional feedback was somehow softened by other Georgian officials saying that Russian market was a “salvation for Georgia”. Wine expert Dmitry Kovalev believes that Georgia didn’t have any chance to re-target at the European markets with their semi-sweet reds that had been so popular with Russian consumers. “I think these wines has just been sitting in the bottles waiting for the embargo to end”, — he said.

After the inspection Onischenko declared that the “approved” wine estates could start preparing the import procedures. Earlier in March he had already mentioned that “about 200” Georgian wines should be able to come back or enter the Russian market for the first time. Information sources in Georgia indicated that some 65 wineries were ready to deal with Russia at the moment.

Russian retailers are ready to put Georgian wines back on shelves as soon as all the import questions are resolved. The wines are expected to compete in the middle price category – around 10 EUR per bottle.

As usual, Russia does not disclose the quality criteria for the wines to enter the market, which gives a lot to speculate about. After the recent visit Onischenko said some wineries had “issues” not mentioning the nature of those.

Russia has been banning Georgian wines and mineral water imports since 2006. It was officially connected with the quality of wines but political reasons were obviously the only ones that mattered.

]]>

The forecasts predict that France, closely followed by the USA, will top the list as the leading importers of Scotch until 2016. The French are expected to consume 174 million bottles of the spirit this year. Robert Beynat, chief executive of Vinexpo, said: “While consumption of whisky in the UK is falling, exports are booming. The emerging countries with a growing middle class are keen to discover and drink Scotch.”

However, it is predicted that French consumption will fall slightly over the three-year period from 2013 to 2016, while demand in the US is expected to increase over the same time period. The UK is currently in third position and is expected to consume 72 million bottles by the end of this year. Russia is expected to overtake the UK by 2016 with their intake set to rise from 56 million bottles in 2013 to 78 million bottles in 2016. Another country rapidly increasing its love for Scotch is Brazil which will be consuming 66 million bottles in 2016. Spain’s forecast is the exact opposite. Both Diageo and Pernod Ricard stated in their half-yearly reports that sales in Spain were falling.

The IWSR research backs this trend and sales of Scotch have steadily decreased in the Iberian country over the past five years, with this trend expected to continue.

The research also claims that the world consumption of Scotch should reach 1.2 billion bottles by 2016.

Source: Drinks Business, 27th February, 2013

]]>The Estates and Wines division presented some of the wines to the press in Moscow on February the 13th.

Fancy enough, with great intake of hi-end presentations equipment, Moët Hennesy, nevertheless, failed to gather any impressive number of media (especially, the kind of glossy magazines journalists one might expect from them). As explained bt the company representatives, they wanted to focus more on professional wine media — quite limited in Moscow.

As Olivier Sauvage, the brand ambassador for Moët Hennessy in Russia mentioned, the company will take care of these brands mostly in on-trade channels where these wines are better suited for sure.

«We see that Russian market has great potential. It is reeling from a few «crises» that hit it over the last few years, but it is pulling through. We strongly believe that market will continue to develop towards more sophistication, consumers start to appreciate quality wines more and more and that is where we find our potential», — he told WRR.

For long time the brands have been represented and distributed by such long-established importers as Whitehall, MBG and others. The desire to take more control of its wine brands is understandable – the company’s great wines portfolio is abviously underestimated and undercommunicated in Russia. This is especially true taking in mind such big brands as Moët Chandon and Hennessy which don’t need much of anything except advertising – which is banned since the beginning of 2013. Big international players are seeking ways to move their ATL budgets to other channels.

]]>

Russian governments have fought the country’s age-old culture of hard drinking for more than a century. A 2011 global report by the World Health Organization (WHO) on alcohol abuse cited Russia and its neighbors as the hardest-drinking countries in the world. Now, provoked partly by a rising tide of youthful beer binge drinking, the government is cracking down on what it sees as an important public health issue.

Few observers think Russia’s newly emerging and increasingly sophisticated fine wine scene was in the sights of the legislature, the Duma, when it enacted the advertising ban last summer. Nonetheless, the law, which took effect Jan. 1, has had an impact. It makes no distinction between beer, wine and spirits. All advertisements are banned in both traditional and online media, and state authorities have warned the ban may be applied to the editorial content of wine publications and newspaper wine columns.

“Wine is not one of the hit targets of the government … yet,” said Spiros Malandrakis, an analyst of the global drinks markets for Euromonitor International, a London-based market research firm. “They mostly focus on hard liquor and beer, but the law makes no distinction.” Beer in particular has been a sore point, and to stem the tide of its growth among young people (Russia’s legal drinking age is 18), the government in recent years has doubled excise taxes, limited hours of sale and, as of January, outlawed sales from sidewalk kiosks.

According to WHO’s 2011 study, the average Russian drinks the equivalent of about 15.7 liters of pure alcohol per year—65 percent more than in the U.S. Nearly two-thirds of the alcohol consumed comes from hard liquor, one third comes from beer and only 1 percent from wine».

]]>Other sources at FAS has indicated clearly that they were not planning any sanctions to the exhibition organizers in respect to the wine tastings if those were held during the event at the producers’ stands (which is always the case as we understand). This controversial information from the government sources brings even more attention to the stupidity and disrespect of the new legislation towards the legal businesses and organizations. Moreover, the FAS representative showed that this legislation can officially be interpreted by them freely and to their benefit – which, of course, includes more bribery and corruption possibilities and gives more illegal control over the exhibition businesses.

FAS representative also mentioned that no punitive actions would be taken unless there are complaints from the exhibition visitors – which is odd enough and, again, puts at random risk any producer trying to organize a tasting at his stand. Trying to avoid possible risks ProdExpo is offering wine producers to organize their tastings outside the exhibition grounds, in the Genatsvale – City restaurant, which is obviously extremely uncomfortable for any of them.

]]>However, it was in need of fairly extensive renovations and the Russian owner Dimistry Stroskin, who runs an import business in Warsaw, was granted planning permission and a renovation permit to restore the building.

The remit included the right to bulldoze some smaller outbuildings, however, the Polish firm assigned to the task took the wrecking ball to the historic property instead – leaving the condemned outhouse as the only building left standing.

Stroskin has said that he spent years searching for his “perfect” French château before “falling in love” with Bellevue. He told local paper Sud-Ouest: “I had no idea the château had been destroyed, I am in shock.”

However, he has accepted the loss saying “the damage has been done” and vowed instead to build an identical château in its place. A Polish architect has apparently drawn up plans and local masons have been given a €1.5 million contract.

Local residents on the other hand are furious, with one telling French television channel M6: “”This wasn’t a slip of a digger, it was done on purpose.” The mayor has called for a halt to all further work until an investigation into why the château was bulldozed has taken place.

This is not the first instance of French residents expressing their dissatisfaction with foreign investors. Earlier this year there was an outcry when a Chinese investor outbid a local co-operative in Burgundy for possession of the mediaeval Château Gevrey-Chambertin.

This article appeared in The Drinks Business International, read original

]]>

MOSCOW, 6-7 Oct 2012. For a couple of days extremely rainy and windy Moscow weather was overrun by fine food and spirits intake. Major cognac brands are doing their best to reinvent themselves in Russia during the Taste of Moscow gastronomic festival that took place last weekend 6-7 of October in the Clumba restaurant situated in Moscow’s central location. Cognac has long been considered a “dead” category used mostly for New Year gifting for your dentist (VSOP, not higher) or an official-to-bribe (XO or higher, depending on the rank and the effect needed). With spirits market growing rapidly cognac producers realize they need to address the trend-setters and opinion leaders and bring the new taste of cognac to younger audiences.

Martell cognac was the central activator during this two-day competition of the star chefs from Moscow restaurants with 16 chefs taking part in the event plus the Chateau de Chanteloup’s (historic and beautiful Martell family Bretagne-style guesthouse) chef Pascal Nebou playing with the Martell Pure Gourmet platform in front of the fancy Moscow public. Pairing fine food and cognac was the leitmotif of the whole festival, no other alcohol was served during the competition. Even wine options were eliminated making cognac the only pairing choice.

Martell cognac was the central activator during this two-day competition of the star chefs from Moscow restaurants with 16 chefs taking part in the event plus the Chateau de Chanteloup’s (historic and beautiful Martell family Bretagne-style guesthouse) chef Pascal Nebou playing with the Martell Pure Gourmet platform in front of the fancy Moscow public. Pairing fine food and cognac was the leitmotif of the whole festival, no other alcohol was served during the competition. Even wine options were eliminated making cognac the only pairing choice.

Russians tend to perceive cognac in a very stereotypical way – fireplace, own house outside Moscow, bourgeois-style atmosphere, warming up the glass with your hand – all of these are bad companions for promoting the brand – demanding special surroundings and occasion to drink the French spirit. Digestive drink perception was the main obstacle Martell wanted to break during the event. While trendy public is already used to fine dining, cognac is still not a part of it. The leading Cognac houses are doing their best to include their drinks into the fine food concept, Hennessy pouring the most budgets on advertising. Considering the approaching advertising ban, this might be the first swift (meaning the “martinet” bird from Martell’s logo) in the new wave of gastronomic promotional activities connected with cognac.

More photos:

]]>Global spirits groups and aspiring brands were present at the second annual Moscow Bar Show (MBS) this week to capitalize on Russian bartenders and distributors’ growing interest in international spirits.

Among the 110 exhibitors at the September 25-27 show were Diageo, Pernod Ricard, Bacardi, Brown-Forman, and Rémy Cointreau, plus a slew of smaller brands seeking representation in the market.

MBS director Andy Bishop, formally of the London Bar Show, told Drinks International that the show had grown since its debut last year. He said he expected 9,000 visitors by its conclusion, up from 6,000 in 2011. He said: “The show is 30% bigger than last year. The big companies have gone to town with their stands.”

“On day one we tend to have a lot of bartenders. The importers and distributors come on day two and three.”

The show is largely Russia and ex-Soviet Union-centric, with around 60% of visitors, estimated Bishop, having travelled from outside of Moscow, particularly from other Russian cities and neighbouring countries such as Latvia and Ukraine.

Much of the activity around stands was demonstration and sampling-led, with more established drinks companies clearly viewing the show as opportunity to educate bartenders as to the uses and USPs of their brands.

For smaller companies such as the UK–based vodka, gin and liqueurs company Chase Distillery, the Czech produced Babicka vodka – also headquartered in the UK – and the Swedish vodka DQ, the primary reason for exhibiting was to appoint a Russian distributor.

Alex Verdutti, sales director for eastern Europe at DQ’s parent company Nordic Spirit, underlined the difficulties in breaking into the Russian vodka market, particularly the luxury channel. “Everybody knows that there is corruption here but it’s an important market for brands. Last year [when we exhibited] four or five companies were interested [in distributing DQ] but they all wanted a big marketing budget. One asked for €10m in the first year.”

James Chase of Chase Distillery was also at MBS to find a distributor for the brand. “It’s like trying to sell sand to the Arabs,” he joked, referring to the Hertfordshire distillery’s major line in vodka. “The gin has been popular, but people are taking to the vodka. The flag, the name…we [the English] are ‘in’ at the moment.”

More established in the market is Nikka whiskey, part of the Asahi Group. Russia is a top-10 export market for the brand and, according to international sales manager Emiko Kaji, Russia represents a big opportunity for the brand’s premium expressions. “In Russia there is an opportunity because Suntory is concentrating on its cheaper lines, like Kukubin. We don’t want to sell cheaper products here, we want to focus on the higher end.”

Nikka, which exhibited both premium blends and single malts at the show, including a range of aged Taketsura and Yoichi expressions, continues to expand its export sales, with Kaji reporting 30% volume growth in the last year.

Asahi has overcome difficulties with bottle sizes in the US (where spirits must be in 75cl form) to land its first shipment of Nikka this year, and through the group’s subsidiary Independent Liquor, the whisky brand will be available in Australia early next year.

Published: Drinks International, 27 Sep 2012. Read original